18+ Assumable mortgage

Ad Simplify Your Search. Find An Online Mortgage Lender With A Great Mortgage Rate.

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

An assumable mortgage is a mortgage that can be transferred from the current owner of the property to the buyer with the terms that were agreed upon originally.

. Wells Fargo Home Mortgage. Get Your VA Loan. You keep the sellers interest rate.

Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage to purchase the property. Contact a Loan Specialist. The buyer takes over the loans rate repayment period current principal balance.

To assume a USDA loan the property must be in. An assumable mortgage allows a buyer to take over or assume the sellers home loan. Many government-backed mortgages including USDA FHA and VA loans are assumable if you meet certain requirements.

In this guide well cover everything you need to know. Fast VA Loan Preapproval. An assumable mortgage is simply put one that the lender will allow another borrower to take over or assume without changing any of the terms of the.

VA Loan Expertise Personal Service. An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage. So lets see how that 570K sale would look like with a mortgage assumption.

Allows another borrower to take over. See reviews photos directions phone numbers and more for the best Mortgages in Las Vegas NV. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

According to our mortgage calculator which you can use to model your own scenario. In order words you are selling your house and the. An assumable mortgage gives you the chance to take on the loan that once belonged to the seller instead of getting a brand new home loan.

Assumable Mortgages in Las Vegas NV. Trusted VA Loan Lender of 300000 Veterans Nationwide. Assuming a mortgage simply means that in a home sale transaction the buyer takes over the existing mortgage held by the seller including the loans outstanding balance.

In July of 2023 the mortgage balance to assume will be 364000. An assumable mortgage is a type of mortgage program that allows you to transfer your mortgage loan to the new buyer of your house. If youre offered an assumable mortgage at 26 youd likely be over the moon.

Name A - Z Sponsored Links. That means a buyer with 3 in.

Benefits Of Buying A Home With A Va Mortgage Loan

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

2

2

2

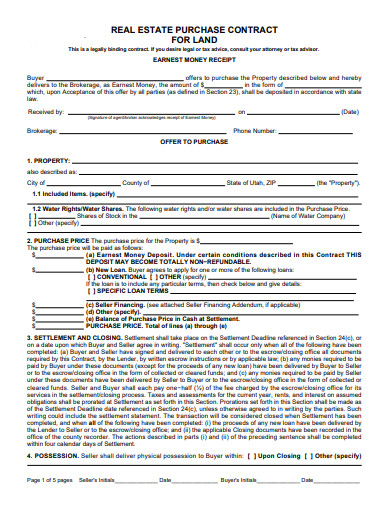

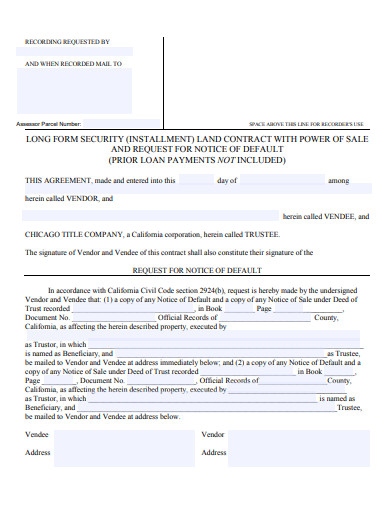

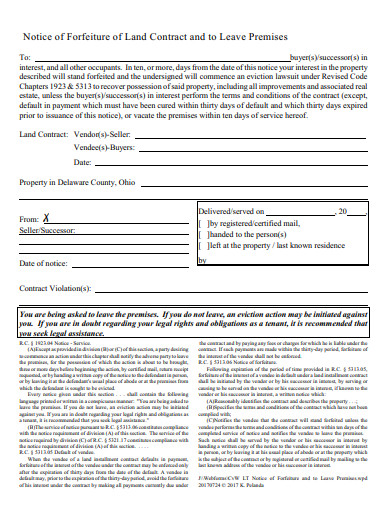

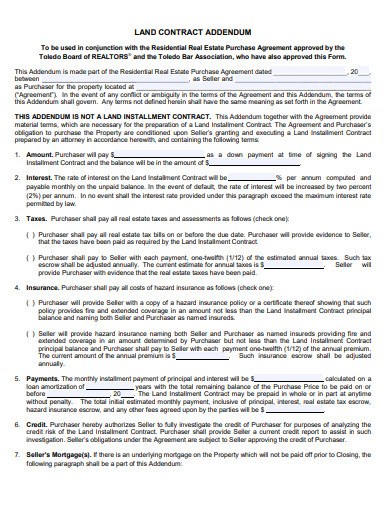

Land Contract Form 10 Examples Format Pdf Examples

The Do S Don Ts When Applying For A Home Loan Mortgage Tips Paying Off Mortgage Faster Fha Loans

Are Fha Loans Assumable In 2022 Fha Loans Fha Mortgage Lenders

Assumable Mortgage Real Estate Terms Interest Rate Rise Low Interest Rate

Land Contract Form 10 Examples Format Pdf Examples

Thisweek Pickerington 3 17 By The Columbus Dispatch Issuu

Clk0dqnky1f96m

Land Contract Form 10 Examples Format Pdf Examples

Real Estate Glossary

Land Contract Form 10 Examples Format Pdf Examples

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha